By Alec Israeli

Stefan Eich’s The Currency of Politics: The Political Theory of Money from Aristotle to Keynes (Princeton, 2022), offers a genealogical history of monetary thought, anchored in precise moments of crisis, with the aim of providing a new language for the democratization of money. In Part II of their conversation (see Part I here), Alec Israeli and Eich discuss the monetary practices of empire, Keynes and Marx, and the meaning of monetary democratization in the neoliberal era.

***

AI: Empire, at times unexpectedly, plays a role in your book’s theoretical narrative. Locke’s political defense of price stability through a metallic standard had everything to do with maintaining Britain’s commercial expansion (of which Locke had a piece); the gold standard later was monetary thing holding the British Empire together in its fin de siècle apex. You also note the exception in the case of India, where Britain’s gold standard deliberately did not apply (instead, Britain maintained a rupee exchange standard in the colony, preventing bullion circulation there), with a younger Keynes defending this exception as a way to bolster the presence of the gold standard throughout the rest of Empire.

There’s a further line of colonial exceptionalism in the last chapter’s discussion of the IMF, which disciplines social spending or capital controls within former colonies— that is, it opposes certain practices it would not necessarily question in the so-called developed world. On a domestic level, too, this epiphenomenal global color line is reproduced: You talk a lot about how racial justice in the US almost necessarily has to involve monetary justice.

So, in your book, there is a consideration of how empire contributed to the development of various monetary theories and how these theories apply.

SE: That’s right, and it is often tied up with naturalizing origin stories. If money is a social relation, it also undergirds and is constitutive of unequal power relations, especially in the context of empire. That allows you to see the way in which power operates—not least by highlighting who has agency.

So the case of India is from this perspective not an idiosyncratic exception, but the proverbial exception that proves the rule; indeed, the exception that makes the rule possible. As Marcello De Cecco already showed in his classic study, it is after all the gold extracted out of India that is being used as a masse de manoeuvre in London. It is the seeming exception of India that allows London to manage the global gold standard.

Agency expresses itself here, as elsewhere, in the ability to act with discretion. That’s an interesting twist of how we often think about empire. It is about the inequalities of power, but also about the different kinds of agency at one’s disposal.

Part of empire’s logic is thus the double standard of who has to follow the rules, and who gets to act with discretion. You see this beautifully in the case of the IMF, when it comes to structural adjustment programs first imposed on Jamaica and Tanzania in the late 1970s, or, even more fundamentally, whether the IMF gets called in the first place. What did Nicolas Sarkozy say in the Eurocrisis when it looked like the IMF might have to get involved in Europe?—“The IMF is not for Europe. It’s for Africa—it’s for Burkina Faso.”

AI: This logic is almost a strange corollary to a European central banker you quote who described Europe as the “thirteenth Federal Reserve District” (211).

SE: In an inverted sense, yes. Here is an example of an exceptional inclusion that is a privilege—you want to be the Fed’s 13th district because it gives you direct access to unlimited dollar liquidity! But what happens to those who don’t get a swap line, who consequently don’t have access to the dollar system? We’re finding that out right now as the Fed raises rates and pushes emerging-market countries into a situation where they can no longer service their dollar debt, while all the hot money pulls out and returns to Wall Street.

That’s another interesting instance where you see the hierarchy of money and its associated power inequalities. As with the gold standard, people have clamored to get on the ladder of a hierarchical system. Even being a lower-tier member of a hierarchical system seems often preferable to being outside the system completely. That assumption is being tested now once more.

AI: So that is where the core internationalist aspect of Keynes’ postwar proposals come in (involving, as you elaborate, a global reserve currency and an international Clearing Union), as well as your own suggestions for democratization.

SE: Yes—the democratization of money isn’t a purely domestic problem. Nor is it just a monetary policy problem, but one that touches on the very constitution of our global monetary system. Here a vast, depressing gap opens up between the ways in which unequal monetary power currently articulates itself internationally, and what it would mean to render such power more equal and democratic.

AI: In this regard, I felt Keynes and his global monetary proposals appeared in the book as a kind of hero in pulling these disparate threads together. Are you pointing toward a missed opportunity in the form of his proposal that didn’t come through in the Bretton Woods agreement? That point in the book was the closest there was of approaching the extractive reading of historical theory which you explicitly oppose.

SE: I think of Keynes as someone who can’t be straightforwardly located on this map, but who instead moves over it, trying to reconcile seemingly irreconcilable positions—and often failing. His proposals do not resolve the paradoxes and tensions inherent in money’s relationship to democracy, as seen by the awkward role that democratic rule plays in Keynes’s vision.

And yet his proposal would be a vast improvement to the mess we’re in! So while I don’t think of Keynes as the book’s hero, we would do much better to live in Keynes’s world than ours. That doesn’t mean that Keynes’s system amounts to the global monetary system’s democratization. And yet, it’s a source of despair that even his proposals, imperfect as they were, were not realized in Bretton Woods and have not been realized since.

That points to a corrective that won’t surprise anyone who’s followed debates about Bretton Woods, but it’s nonetheless worth repeating: the postwar arrangements that we often refer to as Keynesian were not based on Keynes’ ideas. Bretton Woods did not reflect the success of Keynes’s proposal but its displacement by the American plan.

This also means that what happened in the 1970s, from the collapse of Bretton Woods to the experience of stagflation, was not evidence that Keynes’s thought suffered shipwreck. What failed was precisely the ersatz Keynesianism that had displaced Keynes. So there’s an opportunity here to look at Keynes with fresh eyes, not as the hero, but as someone who can at least help us to do a bit better than we’re doing.

***

AI: To continue this theme of contemporary action and past theorizations—drawing you’re your chapter on Marx, we get a metanarrative dealing with Marx as a political theorist, rather than as a thinker of pure critique.

You bring us on this ride with Marx, moving through his accumulating theorizations of money: basically from monetary theory to value theory, concluding that most monetary toying is kind of beside the point, if the aim is social-political transformation (here, seemingly, critique all the way down in the monetary-political realm). But you end the chapter on a note of political hope nonetheless. For Marx, you say, the answer to the question of whether monetary policy was a useful site of political struggle was, given his historical conditions, a definite “no”. He focused on reducing the working day. But your historicizing this answer implies that now, monetary policy is an important site of political struggle. Why? And, not that it has to be an either/or, but why identify this as opposed to, for example, workplace organizing?

SE: I follow William Clare Roberts here in thinking that reading Capital as a scientific work and a work of political theory equips us to better understand some attendant political and theoretical puzzles.

First, there is an interesting problem of rhetoric here, whereby we’ve been misled by the excision of monetary matters from Capital’s first volume, including the removal of much of the history of the politics of money. This has misled many—including many sympathetic to Marx—into believing that Marx wrote in an age before the financialized credit economy, which is obviously not true. So even if you end up agreeing with Marx’s political conclusion, there’s an argument to be made that Marx arrived at this conclusion by way of studying money’s technical and political aspects.

That takes us to the politics. I do not mean to imply that we should shift attention from one site of struggle to another—if anything monetary politics is most effective alongside labor’s mobilization. Control over working time remains the crucial issue. But I do think we have underestimated the ways in which classic questions of labor struggle interact with monetary politics. There is a lot of scope for thinking more creatively about monetary politics as a site of political struggle alongside—and often entwined with—the workplace and working day as sites of mobilization.

To be sure, Marx is constantly polemically pushing back—in both his own notes, and published works like The Poverty of Philosophy— against socialist credit reformers who thought, from his perspective naively, that reforming the monetary system could end exploitation. Marx reminds us that democratizing money alone will not end capitalism. But in doing so, he also forces us to broaden our conception of what monetary reform might mean, what democratizing money might mean, in order to include the economic structure as such (unlike those believing that a different provision of credit might end exploitation). This is a really important corrective.

So I think it would a mistake to conclude from Marx’s account that sites of monetary rule aren’t also sites of class rule, that money is beyond political struggle. From central banks to the banking system to what happens at the IMF, these are absolutely crucial sites of class struggle, even if we can disagree about the strategic prospects for democratization and mobilization.

That’s what I’m trying to add to the overall picture—some of the ways in which the politics of money is one important site in which power and agency play themselves out today, and arguably one site in which agency is much more concrete and formulated than elsewhere. Here, in the form of central banks, we actually have a very small number of people who have real agency. These acts of discretionary power, constrained as they are, are sites of real political struggle.

AI: Given your book’s political subject matter, then, it seems like it came out at an appropriate time. Monetary policy is in the news with rising inflation and the responses of central banks; in the past year or so, too, monetary policy has received more publicized attention from left academics and journalists. Indeed, recent monetary concerns precede the inflation of the past few months and the economic tumult prompted by the Ukraine war. As you point out, COVID and its attendant economic crisis prompted swift monetary action from central banks which showed that money was hardly some natural, unchangeable economic force (in your terms, the power that states have over currency was briefly “demystified”).

Obviously, you can’t have foreseen all this. Nonetheless, could you situate the unfortunate fortuitousness (contradiction intended) of your book coming out in May 2022? How are you thinking about this release in a time seemingly primed for a book like yours?

SE: In many ways things that previously been submerged have now become fully visible. But I am actually curious how people read the book in this new context.

I wrote the book with a longer arc of crisis in mind, dating back to the Global Financial Crisis, the Eurocrisis, and the following waves of austerity. COVID initially rehashed many of the lessons that emerged from the Financial Crisis. The current moment deepened these further and gave them a new twist in the form of the return of inflation driven by surging commodities prices. But not only are the roots of the current crisis deeper than the invasion of Ukraine, many of the most troubling aspects—not least the impact on indebted countries in the Global South—are unfortunately deeply familiar.

So I tend to think of the moment that we find ourselves in as a moment of monetary interregnum, as Adam Tooze has described it in adapting that resonant Gramscian phrase. This means that the old conceptions of money as somehow neutral, as beyond politics, have been discredited, but at the same time we’re intensely grappling with what trust and stability could possibly mean in this current non-system. We live in the ruins of Bretton Woods and are more conscious than ever of how much we lack a proper roof.

This expresses itself currently in a proliferation of crises, whereby addressing one crisis only seems to trigger additional crises. Take inflation: central banks in the Global North (led by the Fed) are raising interest rates in an attempt—however misguided—to restore trust in the value of money, but this meanwhile elicits violent debt crises in the Global South.

For me, that means that any conversation about democratizing money has to be about more than whether the interest rate should be x or y, and instead has to grapple with the institutional and constitutional questions of our global monetary system. This also requires us to recognize that any debate about the monetary system necessarily includes the banking system where the vast majority of our credit money is currently generated and allocated. All that is closely tied to the international dimension, since the global banking system operates de facto in US dollars. The cardinal sin here is that one country’s currency is also the global reserve currency, which implies that one country’s central bank is also de facto the world’s central bank. That cannot but end in tragedy.

So our moment—even more than at the beginning of the pandemic, more than in the Financial Crisis—has illustrated that what might initially have looked like successful tools of crisis fighting during these crises (for example, the swap lines to select central banks, the bailouts) have been at best very incomplete measures that delay and displace crises rather than resolve them. Its clearer than ever that these actions might avert immediate disaster, but they fail to address the underlying problem, and indeed easily contribute to obfuscating the underlying questions about what it might mean to democratize money. That’s the optimistic take—that these crises illustrate that we have to do much more systematic, structural thinking.

AI: To your point about bailouts as a stopgap measure—the example you give in your book is the massive bank bailout that happens in the US in September 2008. That does preserve the banks to some extent, but then it enables them to move forward on these foreclosures that proved disastrous for so many people. So the question was raised, who is this really a bailout for?

SE: The question of bailouts immediately raises a series of political follow-up questions: Monetary stability for whom? Liquidity for whom? And ultimately, whose trust has to be maintained? Despite their recent emphasis on “communication,” it seems that central banks are primarily addressing themselves to financial markets, not to citizens.

***

AI: This again comes back to these questions of agency and purpose central to the political project of your book—that these questions are never about a monetary concept or thing itself, but what you do with the concept or thing.

Zeroing in on trust (as discussed in Part I of this interview) as a social tool of relationship-building: you describe money broadly as a “technology of credit” (5). You’re interested in the ambivalence of it. If we think of money-as-credit fundamentally as an embodiment or mediator of trust, trust itself is the technology that can be used in different ways.

So there’s the aspirational undertone: trust/money can be a wonderful technology of reciprocity to variously order social relations. But we see the tragic way this goes— putatively equal trust existing between banks and the people that they gave home loans to, but obviously this is not a relationship of actual reciprocity. Yet its framed as a such; it is framed by the trust which undergirds a market monetary system, by the contractual logic of equal, consenting parties.

In this case, the potentially hopeful technology of trust is being mobilized within the language of discipline—of personal responsibility, of belt-tightening—that you point out comes out of the inflation-obsessed politics of the 70s and 80s, and the latest wave of money’s depoliticization. This politics of course still dominates today, in which government-financed social welfare is generally replaced by the expansion of personal, individualized credit that allows for something like the massive home loans to even happen.

In a word: what happens to the technology of trust—as an operable, usable thing—in these last 40 years of monetary politics?

SE: To first take a step back before we turn to the 1970s: If money could speak, it would say “trust me”. But that’s obviously exactly what the conman says. We’re always one step away from a confidence trick.

AI: Yeah, I’m reminded of the first scene of Herman Melville’s Confidence Man (a novel about marketplace anxieties, as read alongside Thoreau by Jon Levy in his recent Ages of American Capitalism), we see a sign emblazoned with “No Trust”, alongside the appearance of the titular character. The novel’s organizing paradox is the simultaneity of everyone in the market being concerned everyone else is a conman, so they don’t trust anybody, but they ironically don’t trust anybody in a system of contracts and exchange putatively built upon trust! So there becomes this sense in market society of appealing to trust as this weirdly pre-market value, even as all we do builds upon a trust that cannot be trusted! Appealing to trust is at once the prerogative of a conman, and the prerogative of everyone. Everyone, that is, becomes a conman.

SE: Putting it in the crypto context: “You can’t trust anyone” is the lesson crypto draws from the Financial Crisis. Everyone is a conman, especially the state. If only a technology could allow us to engage in exchange without having to rely on trust! But obviously the need for trust doesn’t disappear. Instead, crypto merely reinscribed trust into the code itself that now has to bear all the trust, with frequently catastrophic consequences. But who writes the code? And who benefits from the uneven anarchic playing field that the code creates? In seeking to escape trust, we fall into new traps of an even greater lack of accountability. Decentralization paradoxically breeds greater dependence.

The recent language of individual trust—like the earlier language of “individual responsibility”—seems to me in this context to be precisely an example of the distorted misappropriation of a social institution. Once you’ve individualized it, what is even left of the meaning of trust? It seems to be something very different at that point.

The kind of trust that we’re meanwhile sorely lacking is trust in our collective agency and trust in an inhabitable future. But that is the kind of trust that would be required for a project of democratization. Now, we’re distrustful for good reasons, given the history of the way in which the language of trust has been mobilized precisely to affirm unequal relations of power, to mystify rather than demystify. At the same time, it seems to me to be short-sighted to entirely give up on our collective agency. Instead we should ask: how do you avoid overburdening the quest for monetary reform, and yet refuse to give up on it? How do you actually continue this idea of the monetary system being a site for political struggle, a place where claims to collective agency can be made, without reducing the political complexity of the challenge? Now, that’s a really uncomfortable position to be in, but the alternatives seem to me to be worse.

AI: But in its most good faith, optimistic forms, trust is indeed the neoliberal promise—that everybody having access to credit, everyone being an entrepreneur, and so on, can participate in this system of trust and everybody can benefit from it on an individual level.

SE: Yet that is attempting to solve the problem by dis-solving it, because at this point you’ve reduced collective agency to nothing more than the sum of market-mediated individual agencies, of each and everyone pursuing their self-interest. That’s not the kind of collective agency I’m interested in.

Instead, we should ask what genuine trust in our collective agency might look like in contemporary capitalism. Not trust in an external institution, gold, Bitcoin, whatever; not trust in our self-interest; nor trust in some benign group of (often unelected) technocrats. These are the forms of trust that fed the neoliberal model with its simultaneous insistence that some external force—be it the invisible hand of the market or the visible hand of the central banker—will steer us through the storm, and that in any case there is no alternative.

If we instead turn our attention in earnest to the challenge of how to bring back trust in our own collective agency, I think that’s where the centrality of language and narrative comes back in with all the problems that beset them. But this is precisely the point at which having a better sense of past monetary crises matters so crucially. How did we end up in a place where trust is this scarce commodity that is itself commodified? How do we escape the temptations of reducing money to a conservative morality tales and instead embrace it as a reflexive institution with an undetermined relation to democracy? To begin to rise to such democratic challenges we will need both better histories and better linguistic toolkits.

One simple example for both is that we need a better conceptual and historical account of what is often referred to as the “depoliticization” of money. Not only does that misleadingly suggest that money somehow ceased to be political, it also obscures the ongoing agency that characterizes “depoliticized” money. As I argue in the book, a more apt description would instead highlight the way in which the politics of “depoliticization” instead a strategy of “de-democratization.” This conceptual shift can help us to formulate a better understanding of the political pressures that time and time again fuel the seductions of a politics of depoliticization that is necessarily incomplete, that necessarily fails, and that nonetheless keeps on getting resurrected. The emphasis on “de-democratization” has at the same time also more immediate political consequences because it flags that the challenge is not simply to “repoliticize” money, but instead to enquire what kind of politics currently drives it and what avenues toward democratization there are.

Alec Israeli is a recent alumnus of Trinity College, University of Cambridge, where he earned an MPhil in Political Thought and Intellectual History as a recipient of a Dunlevie King’s Hall Studentship. His research considers overlaps of intellectual history and labor history in the 19th-century Atlantic world, focusing on theorizations of free versus unfree labor in both political-economic and metaphysical terms. He is additionally interested in the philosophy of history (and the history of the philosophy of history). Alec received a BA in History from Princeton University. His work has also appeared in the Vanderbilt Historical Review, the Columbia Journal of History, the Princeton Progressive Magazine, and the Mudd Library Blog.

Edited by Tom Furse

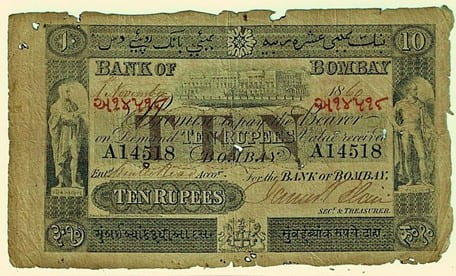

Featured Image: An 1860 bank note for ten rupees, from the Bank of Bombay. Source: Wikimedia Commons, courtesy of Nilaish World Banknotes.